Understanding IRA Gold Custodians: A Comprehensive Guide

페이지 정보

본문

In recent times, the curiosity in gold and other precious metals as a form of investment has surged, notably in the context of Individual Retirement Accounts (IRAs). An IRA gold custodian performs an essential function in this funding technique, offering the mandatory providers to hold and manage precious metals within a retirement account. This article will delve into the concept of IRA gold custodians, their features, regulations, and the benefits they supply to investors.

What's an IRA Gold Custodian?

An IRA gold custodian is a financial establishment or a specialized company that manages the assets of a self-directed IRA that holds gold and different treasured metals. Unlike traditional IRAs, which frequently invest in stocks, bonds, and mutual funds, a self-directed IRA permits investors to diversify their portfolios by including various property akin to gold, silver, platinum, and palladium. The custodian is liable for the safekeeping of these bodily property, ensuring compliance with IRS rules, and facilitating transactions associated to the account.

The Position of an IRA Gold Custodian

The primary tasks of an IRA gold custodian embody:

- Account Administration: The custodian manages the administrative elements of the IRA, together with account setup, file-preserving, and reporting to the IRS. They ensure that each one transactions adjust to IRS laws to take care of the tax-advantaged standing of the IRA.

- Safekeeping of Belongings: IRA gold custodians are liable for the physical safety of the gold and different treasured metals held within the account. This usually includes storing the property in safe, IRS-accredited depositories.

- Facilitating Transactions: When traders determine to buy or promote gold inside their IRA, the custodian facilitates these transactions, guaranteeing that every one processes are executed in keeping with IRS guidelines.

- Tax Reporting: The custodian prepares the mandatory tax documents and studies for the IRS, guaranteeing that the investor stays compliant with tax regulations.

- Providing Steerage: Many custodians offer educational assets and steering to help buyers perceive the intricacies of investing in gold and the associated regulations.

Laws Governing IRA Gold Custodians

The inner Income Service (IRS) has particular rules relating to the storage and administration of gold inside IRAs. Listed here are some key points to consider:

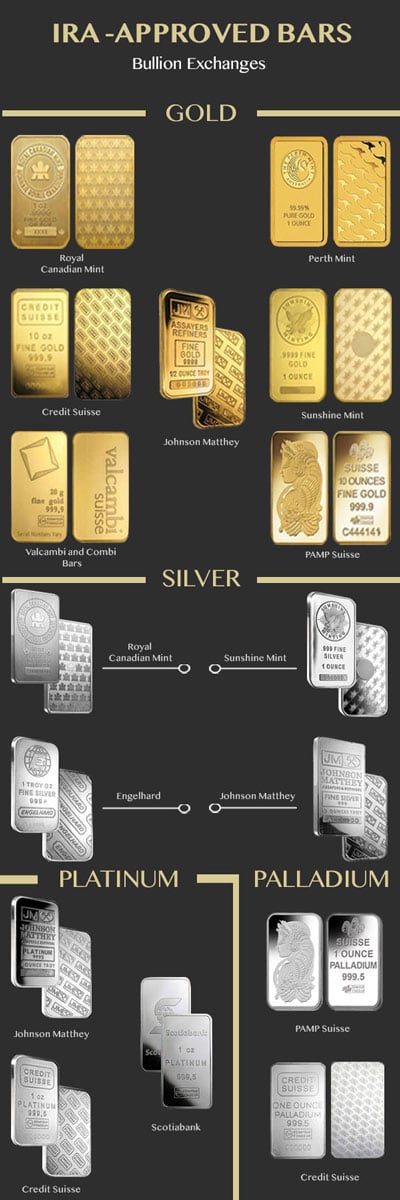

- Eligible Metals: Not all gold is eligible for inclusion in an IRA. The IRS permits only sure varieties of gold bullion and coins, which should meet a minimal purity commonplace of 99.5% for gold. Frequent eligible objects embrace American Gold Eagles, Canadian Gold Maple Leafs, and gold bars from accredited refiners.

- Storage Requirements: The IRS mandates that every one physical precious metals held in an IRA must be saved in a secure, IRS-accredited depository. This means that investors cannot take private possession of the gold, as doing so would set off penalties and disqualify the IRA.

- Custodian Selection: Traders must select a custodian that's permitted by the IRS to handle self-directed IRAs holding valuable metals. It’s crucial to conduct thorough analysis and due diligence to pick out a reputable custodian.

Advantages of Utilizing an IRA Gold Custodian

Investing in gold by an IRA presents a number of benefits, particularly when managed by a professional custodian:

- Diversification: Gold is commonly seen as a hedge in opposition to inflation and market volatility. By together with gold in an IRA, buyers can diversify their portfolios, comprehensive gold ira investment guide potentially reducing total risk.

- Tax Advantages: IRAs offer tax-deferred growth, meaning that traders do not pay taxes on features till they withdraw funds during retirement. This may result in vital tax financial savings over time.

- Professional Management: IRA gold custodians provide knowledgeable management of valuable metals investments, ensuring compliance with regulations and facilitating transactions effectively.

- Safety: Storing gold in an IRS-permitted depository supplies a better level of security in comparison with maintaining bodily gold at residence. These depositories are outfitted with advanced safety measures to guard the property.

- Liquidity: A custodian can facilitate the shopping for and promoting of gold, offering investors with liquidity when wanted. This may be significantly helpful during instances of financial uncertainty.

Choosing the proper IRA Gold Custodian

Deciding on the fitting IRA gold custodian is crucial for a profitable funding expertise. Listed here are some elements to think about when making your choice:

- Repute and Expertise: Look for custodians with a solid fame and intensive experience in managing valuable metals IRAs. Verify for critiques, scores, and any potential complaints.

- Charges and Costs: Different custodians have varying payment constructions. It’s necessary to grasp all related prices, together with setup charges, annual maintenance fees, and storage charges, to keep away from any surprises.

- Customer support: A custodian with excellent customer service can present valuable assist and steering throughout the investment process. If you have any queries about where by and how to use comprehensive gold ira investment guide, you can contact us at the webpage. Consider whether or not they offer educational assets and responsive communication.

- Storage Choices: Ensure that the custodian uses a safe, IRS-authorized depository for storing your gold. Inquire about the safety measures in place and whether the depository is insured.

- Transparency: A good custodian must be clear about their processes, fees, and insurance policies. They need to present clear documentation and be willing to reply any questions you might have.

Conclusion

An IRA gold custodian performs a vital function in enabling buyers to include treasured metals of their retirement portfolios. By understanding the capabilities, laws, and benefits of custodians, traders can make informed decisions about their gold investments. As with all funding, due diligence is important in choosing a custodian that aligns together with your financial goals and offers the security and experience needed to navigate the complexities of valuable metals investing. With the appropriate custodian, investing in gold by means of an IRA can be a rewarding strategy for building wealth and securing monetary stability for the future.

- 이전글They Compared CPA Earnings To These Made With Naruto Merch. It's Sad 25.08.07

- 다음글도도걸사이트 주소ッ (1080p_즉시)도도걸사이트 주소ッ 풀ver-HVD 25.08.07

댓글목록

등록된 댓글이 없습니다.