The Golden Investment: A Complete Information To Buying Gold Bullion

페이지 정보

작성자 Bernadette 작성일 25-08-03 23:10 조회 4 댓글 0본문

Lately, gold has regained its standing as a protected-haven asset, with many buyers turning to gold bullion as a means of defending their wealth amidst financial uncertainty. The allure of gold as a tangible asset, coupled with its historical significance as a store of value, makes it an attractive option for both seasoned buyers and newcomers alike. This text will discover the necessities of buying gold bullion, together with its benefits, sorts, buying methods, and key issues.

Understanding Gold Bullion

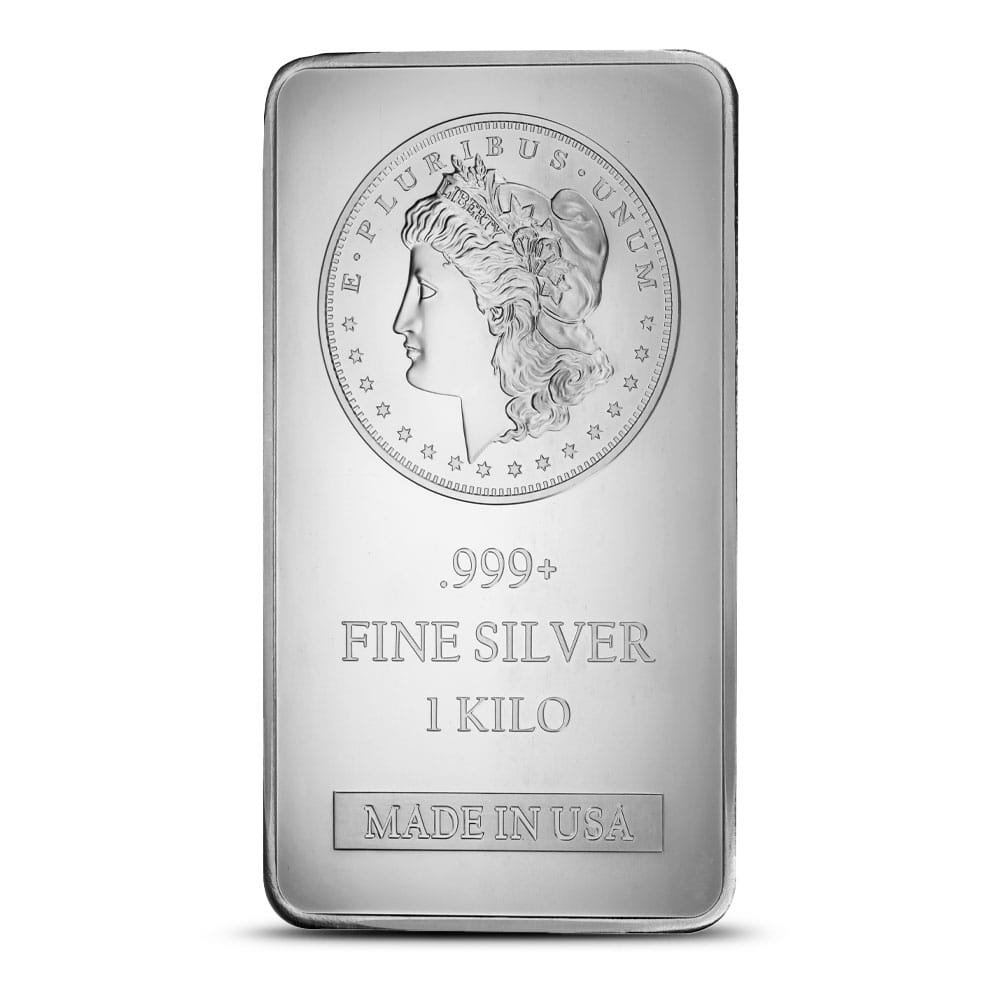

Gold bullion refers to gold that's in bulk kind, sometimes within the form of bars or coins, and is valued primarily based on its weight and purity quite than its numismatic value. The purity of gold bullion is measured in karats, with 24 karats representing pure gold. Gold bullion is commonly produced by authorities mints or personal refiners and is acknowledged worldwide.

Why Invest in Gold Bullion?

- Hedge Towards Inflation: Gold has traditionally maintained its value throughout inflationary intervals. When fiat currencies lose purchasing power, gold tends to retain its value, making it a preferred choice for investors looking to preserve wealth.

- Diversification: Including gold bullion in an investment portfolio can provide diversification. As an asset class, gold usually moves independently of stocks and bonds, which might help mitigate risks related to market volatility.

- Tangible Asset: Unlike stocks or bonds, gold bullion is a bodily asset that you would be able to hold in your hand. This tangibility can present peace of thoughts for traders who prefer to own something concrete.

- International Acceptance: Gold is recognized and accepted worldwide, making it a liquid asset that may be simply purchased or sold in numerous markets.

Sorts of Gold Bullion

When considering an investment in gold bullion, it’s important to know the totally different forms it could actually take:

- Gold Bars: Gold bars can be found in numerous weights, starting from one ounce to larger sizes like 400 ounces. They're usually stamped with the load, purity, and the manufacturer's brand. Bars often include lower premiums over the spot worth of gold in comparison with coins.

- Gold Coins: buy gold online website Gold coins are minted by governments and are often more recognizable than gold bars. Popular gold coins embrace the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand. Coins often have a better premium on account of their numismatic worth and recognition.

- Gold Rounds: Just like coins however not government-issued, gold rounds are produced by private mints. They come in various designs and are usually inexpensive than coins.

Where to Buy Gold Bullion

Investors have a number of options relating to buying gold bullion:

- Local Coin Retailers: Many cities have local coin outlets the place buyers can buy gold bullion. This feature allows for in-individual transactions, and patrons can inspect the merchandise earlier than buying. However, native retailers might charge greater premiums because of overhead prices.

- Online Dealers: Quite a few reputable online dealers provide gold bullion for sale. These dealers typically present competitive costs and a wider choice of merchandise. It's essential to analysis on-line dealers to make sure they've a great reputation and safe cost strategies.

- Mints: Authorities mints promote gold bullion directly to the general public. For instance, the U.S. Mint sells American Gold Eagles and other bullion products. Shopping for immediately from mints can generally end in decrease premiums, however availability might fluctuate.

- Precious Metals Exchanges: Some exchanges concentrate on valuable metals, allowing investors to buy and sell gold bullion in a regulated environment. These exchanges might provide competitive pricing and liquidity.

Key Considerations When Buying Gold Bullion

- Spot Value: The spot worth of gold fluctuates all through the day based mostly on market demand and provide. When buying gold bullion, it is essential to remember of the current spot value and the premium charged by the supplier.

- Premiums: The premium is the quantity added to the spot price to cover the prices of minting, distribution, and dealer margins. Premiums can range significantly between different types of bullion and sellers. Evaluate premiums before making a purchase.

- Storage and Security: Once you purchase gold bullion, consider how you will store it. Choices embody house safes, safety deposit bins, or third-get together storage amenities. Every option has its advantages and drawbacks, including cost and accessibility.

- Insurance: Insuring your gold bullion is a wise choice, especially if you happen to store it at house. Insurance coverage can protect in opposition to theft or loss, offering peace of mind.

- Resale Worth: Consider the potential resale value of your gold bullion. While gold typically maintains its value, the resale price may be affected by market situations and buy gold online website the kind of bullion you own.

Conclusion

Investing in gold bullion could be a prudent choice for those seeking to diversify their portfolios and hedge towards economic uncertainty. With its historical significance, tangible nature, and world acceptance, gold has proven to be a reliable retailer of value. If you have any questions regarding exactly where and how to use sun-clinic.co.il, you can get in touch with us at the web page. Nonetheless, potential investors ought to conduct thorough analysis, understand the varied kinds of bullion obtainable, and punctiliously consider the place and the way to buy their gold.

As with all funding, it's important to method the market with caution, keep knowledgeable about market traits, and consult financial advisors if vital. With the fitting data and strategy, buying gold bullion could be a rewarding addition to your funding portfolio, providing each security and potential for future growth.

- 이전글 This Is How Residential Door Installers Will Look Like In 10 Years' Time

- 다음글 처방전 필요없는 비아그라 ( ssww99.xyz ) - 구매처 및 추천

댓글목록 0

등록된 댓글이 없습니다.