Observational Research on IRA Gold Investing: Traits, Benefits, And Co…

페이지 정보

본문

In recent times, the concept of investing in gold by means of Individual Retirement Accounts (IRAs) has gained important traction among buyers searching for to diversify their portfolios and hedge in opposition to economic uncertainties. This observational analysis article aims to explore the trends, benefits, and issues related to IRA gold investing, drawing insights from numerous market analyses, investor behaviors, and financial knowledgeable opinions.

The Rise of Gold as an Investment Vehicle

Historically, gold has been considered as a safe-haven asset, particularly during times of economic instability. The 2008 financial disaster and the subsequent financial downturn heightened consciousness of the importance of asset diversification. Because of this, many investors began to discover various investment options, together with treasured metals. This development has continued to grow, with gold being a main focus for these seeking to safeguard their retirement financial savings.

In accordance with information from the World Gold Council, global gold demand has seen a gradual enhance over the previous decade, gold ira companies top rated with vital contributions from each institutional and retail buyers. Particularly, the demand for gold-backed IRAs has surged, reflecting a broader shift towards tangible assets in investment strategies. This pattern is particularly evident among older traders who're more risk-averse and prioritize wealth preservation as they method retirement.

Understanding IRA Gold Investing

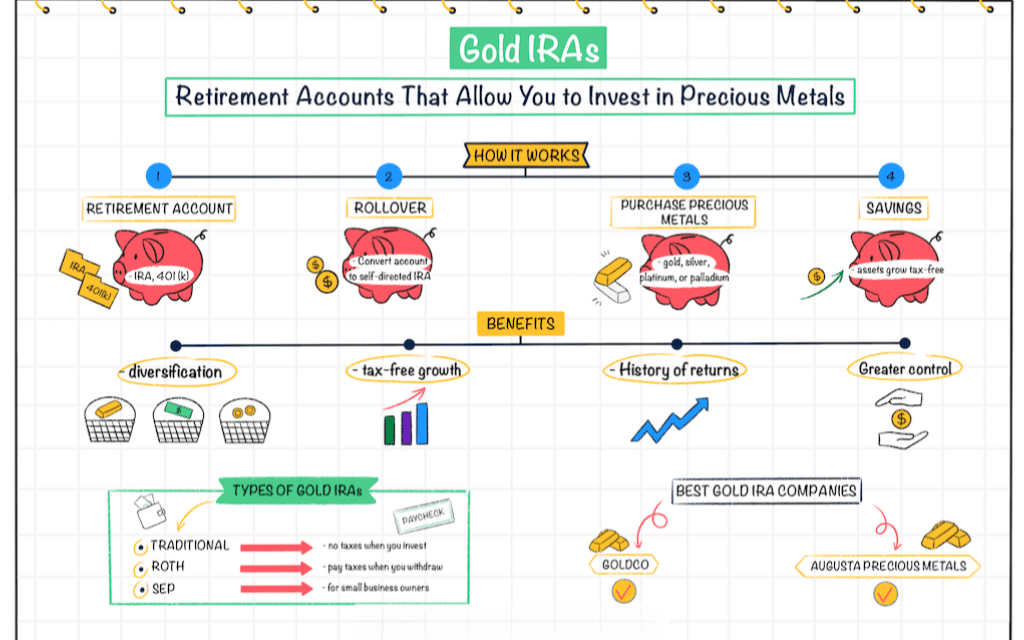

An IRA gold investment allows individuals to hold bodily gold within their retirement accounts. That is made attainable by means of a self-directed IRA, which gives traders with the flexibleness to choose different property past conventional stocks and bonds. To qualify for gold ira companies top rated tax advantages, the gold must meet particular purity requirements and be saved in an IRS-authorised depository.

The allure of gold investing within an IRA lies in its potential for lengthy-term appreciation and its capacity to act as a buffer in opposition to inflation. As fiat currencies fluctuate and economic situations change, gold often retains its worth, making it an attractive option for those looking to safe their monetary future.

Advantages of Investing in Gold by means of an IRA

- Diversification: Considered one of the primary advantages of together with gold in an IRA is portfolio diversification. By allocating a portion of retirement financial savings to gold, buyers can mitigate dangers related to market volatility and gold ira companies top rated financial downturns. Gold typically behaves differently than stocks and bonds, providing a counterbalance throughout turbulent occasions.

- Inflation Hedge: Gold has traditionally been viewed as an efficient hedge in opposition to inflation. As the price of residing rises, the value of gold ira companies top rated (wp.nootheme.com) tends to increase, preserving purchasing power for buyers. This characteristic makes gold a compelling possibility for those concerned in regards to the lengthy-term effects of inflation on their retirement savings.

- Tax Advantages: Investing in gold by means of an IRA provides tax advantages that can improve overall returns. Good points on gold investments held within a conventional IRA are tax-deferred till withdrawal, while those in a Roth IRA can grow tax-free. This tax effectivity can significantly affect the worth of an investor's retirement portfolio over time.

- Tangible Asset: Unlike stocks or bonds, gold is a bodily asset that can be held and saved. For many investors, the tangible nature of gold gives a sense of safety and stability. In occasions of financial disaster, having access to a physical asset will be reassuring.

Considerations and Challenges

While the benefits of IRA gold investing are compelling, there are additionally several issues and challenges that investors should remember of:

- Storage and Insurance Prices: Physical gold should be saved in an IRS-authorised depository, which regularly incurs storage fees. Moreover, investors may need to buy insurance to guard their belongings, including to the general price of gold investing. These bills can eat into potential profits and must be factored into investment decisions.

- Market Volatility: Though gold is often thought of a protected-haven asset, gold ira companies top rated it isn't immune to market fluctuations. Prices might be influenced by various components, including geopolitical occasions, modifications in curiosity rates, and shifts in investor sentiment. Buyers ought to be ready for the possibility of brief-time period worth volatility.

- Liquidity Concerns: Promoting bodily gold can be more advanced than trading stocks or bonds. Buyers may face challenges to find consumers or may must promote at a discount to market worth. This lack of liquidity can be a drawback for individuals who may need quick access to money.

- Regulatory Compliance: Navigating the regulatory landscape of IRA gold investing could be complex. Investors must ensure that their gold meets IRS requirements and that they comply with all relevant laws. Failure to take action can result in penalties and tax liabilities.

Investor Behavior and Developments

Observational analysis into investor behavior reveals several developments in IRA gold investing. Many investors are more and more turning to gold as a means of protecting their wealth in unsure economic occasions. This shift is especially evident amongst younger buyers who, having witnessed the impact of monetary crises on their mother and father' and grandparents' financial savings, are more inclined to discover alternative investments.

Additionally, the rise of digital platforms and investment apps has made it easier for people to entry gold investments. These platforms often provide educational sources, permitting buyers to make knowledgeable selections about together with gold in their retirement portfolios.

Conclusion

IRA gold investing presents a unique opportunity for people looking for to diversify their retirement portfolios and safeguard their financial savings towards financial uncertainties. Whereas the advantages of investing in gold are evident, potential traders should also consider the associated challenges and prices. As the market for gold continues to evolve, staying knowledgeable about tendencies and finest practices can be important for making sound funding choices. In the end, a nicely-researched approach to IRA gold investing can lead to a extra secure monetary future for retirees and traders alike.

- 이전글Exploring the Evolution of Sugar Daddy Sites in Phoenix: A new Era of Connection And Alternative 25.08.04

- 다음글Greatest Places To Buy Gold Bars Online 25.08.04

댓글목록

등록된 댓글이 없습니다.